U.S. and Israel Discuss Potential Strikes on Iranian Oil Facilities

U.S. and Israel Discuss Potential Strikes on Iranian Oil Facilities

Friday, october 3, 2024

Tensions in the Middle East have triggered a spike in oil prices as fears grow over the potential for a broader conflict between Israel and Iran. U.S. President Joe Biden confirmed that his administration is in discussions with the Israeli government about possible strikes on Iranian oil infrastructure, following Tehran’s recent missile attacks on Israeli territory.

Biden Confirms Talks on Possible Actions Against Iran

During a brief press interaction before heading to the southern United States, President Biden revealed that the U.S. is "discussing" Israel’s potential retaliatory measures against Iran's oil facilities. This conversation arises amidst heightened hostilities, after Iran fired 200 ballistic missiles at Israel. Despite the mounting tension, Biden clarified that no immediate actions are planned at this time.

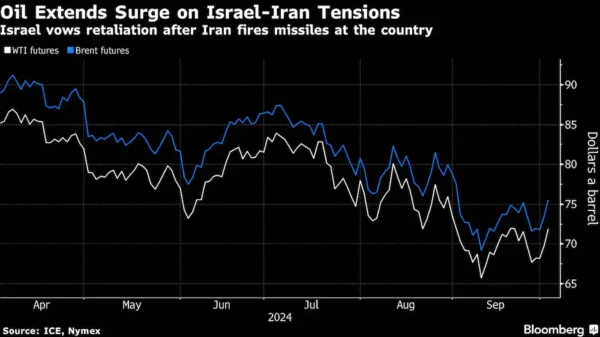

Impact on Oil Prices

The uncertainty in the region has led to a surge in oil prices. Brent crude, the global benchmark, climbed above $75 per barrel, marking a 2.5% increase. Meanwhile, West Texas Intermediate (WTI) rose 2.8%, reaching $71.79 per barrel. This price hike reflects the increased perception of risk to global oil supply, as the Middle East accounts for roughly one-third of the world’s oil production.

Market Reaction to Geopolitical Crisis

The recent uptick in oil prices highlights an increased geopolitical risk premium for crude as investors brace for a potential escalation. Harry Tchilinguirian, head of research at Onyx Capital Group, explained that the market is closely watching Israel’s response to the Iranian missile strike, especially given Prime Minister Netanyahu’s apparent willingness to escalate militarily.

While previous oil price spikes linked to Middle Eastern tensions have been short-lived, experts warn that this time could be different. Analysts at Goldman Sachs noted that the market remains highly sensitive to any disruption risks, despite the geopolitical risk premium not yet reaching extreme levels

Future Outlook for the Middle East and Oil Supply

Though the conflict between Iran and Israel is long-standing, concerns over a larger-scale war now loom larger, raising alarms in global energy markets. Iran produced approximately 3.3 million barrels per day in September, and any significant disruption could have a profound effect on global oil supply.

In the meantime, OPEC+ has scheduled a meeting to review global oil markets amidst the ongoing volatility. The group is set to discuss adjustments to production levels, which have been curtailed since December, as they seek to stabilize prices amid growing uncertainty in the region